Digital currency markets have been consolidating since the initial price drop on February 26 that saw $25 billion shaved off the entire cryptocurrency market. At the time of publication, the cryptoconomy is hovering just above the $245 billion zone and a few coins today are making slight gains.

Also read: MTV Airs Only the Negative Parts of Crypto Youtuber ‘Ya Girl’ Rachel Siegel’s Bitcoin Analysis

As Crypto Markets Consolidate, Traders Await the Next Move

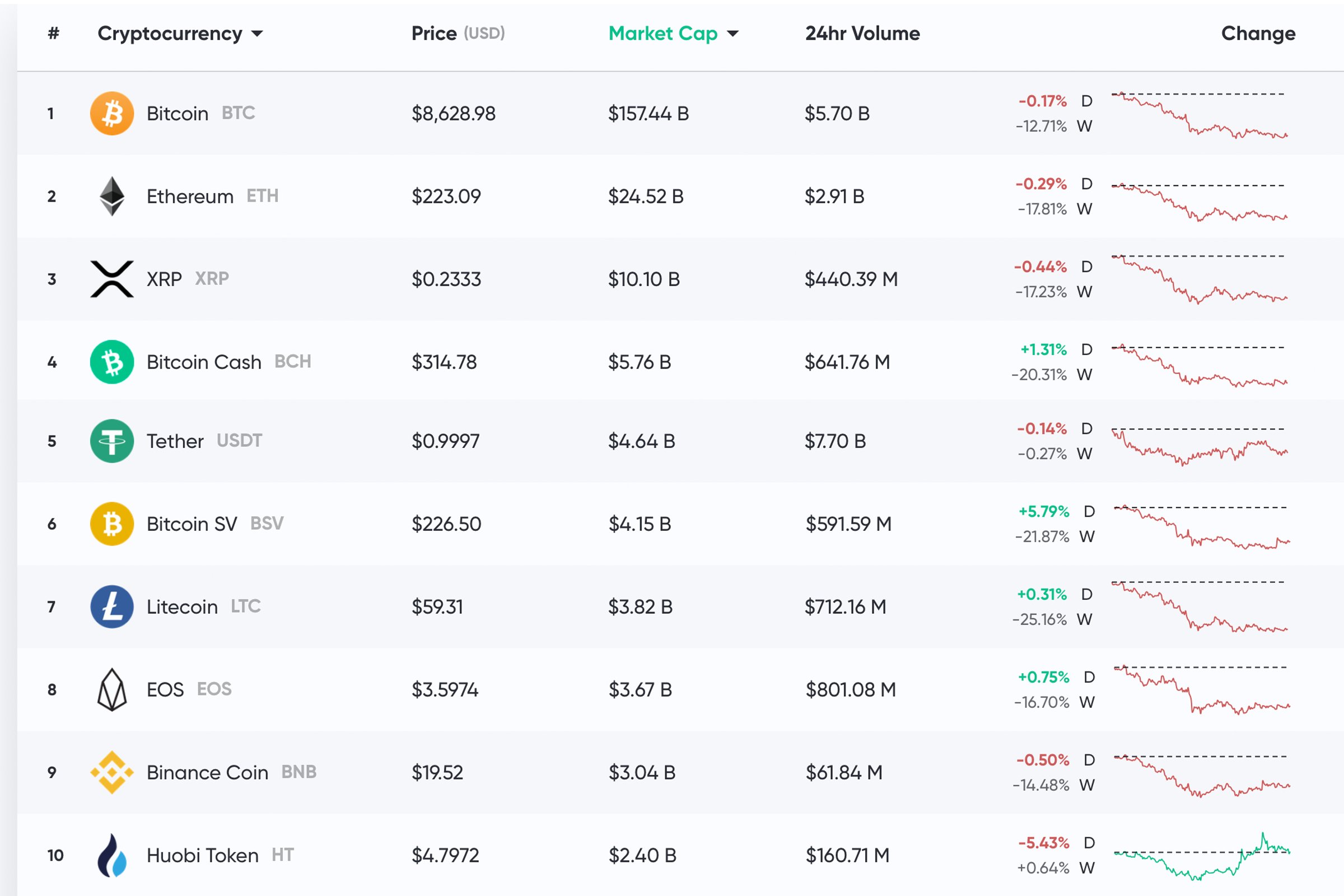

On Sunday, March 1, 2020, most digital currencies have been consolidating into a triangular pattern and a slew of assets have been forming firmer support zones. During the course of the last five weekdays, global stocks have crashed significantly. The crash has been widely blamed on the coronavirus (COVID-19) and stocks haven’t been routed this hard since 1987. Every market including safe-haven assets like precious metals and uncorrelated assets like cryptocurrencies has felt the wrath. Currently, the entire market cap of all 5,000+ coins is around $245 billion and there is $130 billion in reported crypto trade volume on Sunday. BTC has been hovering between $8,575 to $9,650 during the last 24 hours and the currency is down 12.7% for the week. Still, over the last 90 days, BTC is up 18% and over the course of the last 12 months, BTC is up 123%. The second-largest crypto by market cap is ETH which is trading for $223 per coin.

ETH is down 17.8% for the week but still up 34% during the last 30 days. So far, ETH has gained 50% during the last three months and over 67% for the past 12 months. Behind ETH, XRP is trading for $0.23 per token and has lost 17.2% in the last seven days. XRP has seen little increases in value as it’s only up 5.4% during the last 30 days and 6.5% for the last 90. However, during the last 12 months, XRP is down 26% against the U.S. dollar. BTC’s market share compared to the rest of the cryptoconomy is over 63% today.

Bitcoin Cash (BCH/USD) Market Action

Bitcoin Cash (BCH) is coasting along at $314 per coin and is up 1.36% this Sunday. During the last 30 days, BCH has lost a touch over 9% but the asset is still up 47.6% for the last 90 days. During the last 12 months against the U.S. dollar, BCH has gained more than 136% in value.

Reported BCH trade volume on March 1 is $4 billion, but Messari’s “real volume” index shows $18 million in BCH trades today. The top currency pair traded with BCH today is tether (USDT) which is capturing 66.5% of all BCH trades. This is followed by BTC (17%), USD (11.5%), KRW (1.68%) and ETH (1.86%). On February 28, Fxstreet analyst Ken Chigbo detailed that BCH/USD prices have slid downwards consecutively for three weeks. Chigbo notes that if the psychological $300 mark is breached, BCH/USD could see “a strong wave of downside.”

“The price is running towards its third consecutive week in the red,” the analyst wrote on Friday. “It has very much been the case since the evening star formation in the week of 14 February, a strong signal provided for a reversal.”

Coronavirus Fears Strike Crypto Markets

Last week saw global stock markets plummet as coronavirus fears gripped capital markets. Even safe-haven assets like gold tumbled during the course of the week and on February 28, Market Watch reported that gold saw its biggest daily slide in nearly seven years. “Investors rush to sell gold and generate cash to cover stock market losses,” explained Market Watch reporters Myra Saefong and Mark DeCambre. The coronavirus crypto market sell-off has been similar and people speculate that the scare could make matters worse for assets like BTC.

On February 24, chief investment officer for Arca Funds, Jeff Dorman, told the columnist Bradley Keoun during a phone interview that cryptos like bitcoin are “largely disconnected from Wall Street.” “It’s irresponsible for anyone to say that bitcoin is truly a safe haven,” Dorman remarked. “Look at how gold and Treasuries and equities react instantaneously to global fears. Bitcoin and digital assets live outside that workflow.” Three days later, Dave Waslen, CEO of Hedgetrade, noted: “During the first weeks of the Coronavirus, bitcoin acted as the uncorrelated asset that it has often been during economic and political upheaval, showing strong growth.” But this week was a different story as Waslen further stated:

The last two days took their toll on crypto’s most important digital asset. Bitcoin price fell 6% since Monday morning. Still, bitcoin’s value isn’t derived from the same indicators as fiat, such as interest rates and GDP. Instead, bitcoin is purely driven by demand, which is why it often remains steady when other markets are teetering.

Bitcoin All-Time High Predictions Still in Full Force

Despite the downturn in crypto markets, many speculators think BTC will touch all-time highs (ATH) again in the near future. It’s been over two years since BTC’s ATH at $19,600 and the currency is still 57.28% down from that ATH. During an interview with Kitco News on February 25, co-host of ABC’s “Shark Tank,” Robert Herjavec, explained that he believes BTC prices will “quantuple [quadruple i.e. 4x].” “I think the price of Bitcoin, on a long-term basis, will quantuple, if that’s a word,” Herjavec said. “Consumers, over the long run, always go to convenience, and bitcoin is just convenience.”

‘Everyone Should Have 1% of Their Assets in Bitcoin’ Says Virgin Galactic Chairman

The current chairman of Virgin Galactic told CNBC’s Squawk Box that he thinks everyone should hold a small fraction of BTC. “Everybody should probably have 1% of their assets in Bitcoin,” Virgin Galactic’s Chamath Palihapitiya said on February 26. Palihapitiya strongly believes that BTC is a “fantastic hedge” and continued to elaborate on the benefits of this “uncorrelated asset.”

“When you see the amount of leverage the financial industry is running, and you think about all these dislocations and all these exogenous things that are happening that you can’t predict,” Palihapitiya insisted. “There’s a lot of risk to the downside, and it will be great that an average individual citizen, of any country in the world, has an uncorrelated hedge.”

Where do you see the cryptocurrency markets heading from here? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.” Cryptocurrency prices referenced in this article were recorded on Sunday, March 1, 2020, at 10:00 a.m. ET.

Images via Shutterstock, Trading View, Bitcoin.com Markets, Twitter, Shark Tank, Fair Use, Pixabay, and Wiki Commons.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.