Key Notes

- Large holders, including a dormant Uniswap team wallet, have sold millions of UNI tokens.

- Bitcoin’s fall below $104K has intensified selling pressure across altcoins.

- Despite heavy offloading, Uniswap shows resilience with an intraday gain of 0.48%, holding key support levels.

- UNI token price forms a triangle pattern; a breakout could target $19.45 or higher.

With Bitcoin

BTC

$104 281

24h volatility:

2.7%

Market cap:

$2.06 T

Vol. 24h:

$104.63 B

crashing down under $104K, the altcoins face a surge in selling pressure. Amidst this turbulence, Uniswap

UNI

$16.39

24h volatility:

2.1%

Market cap:

$9.84 B

Vol. 24h:

$949.75 M

defies the odds, maintaining a positive trajectory and dominating above $16.

The broader market correction warns of incoming supply as the DeFi tokens continue to hold their ground. However, the pressing question remains: Will Uniswap succumb to the pressure and crash under $15 as Bitcoin eyes a potential drop to $100K?

Whales Offload Massive Supply of Uniswap

Institutions have started to book profits in their DeFi tokens as the broader market correction intensifies. Over the past two days, institutions have deposited UNI tokens over multiple exchanges.

The whale “0x59A” held a portfolio worth $89.4 million and deposited 1.495 million UNI tokens on Binance. The $24.3 million deposit secured a profit of $13.7 million, marking a significant return of 129% in just five months.

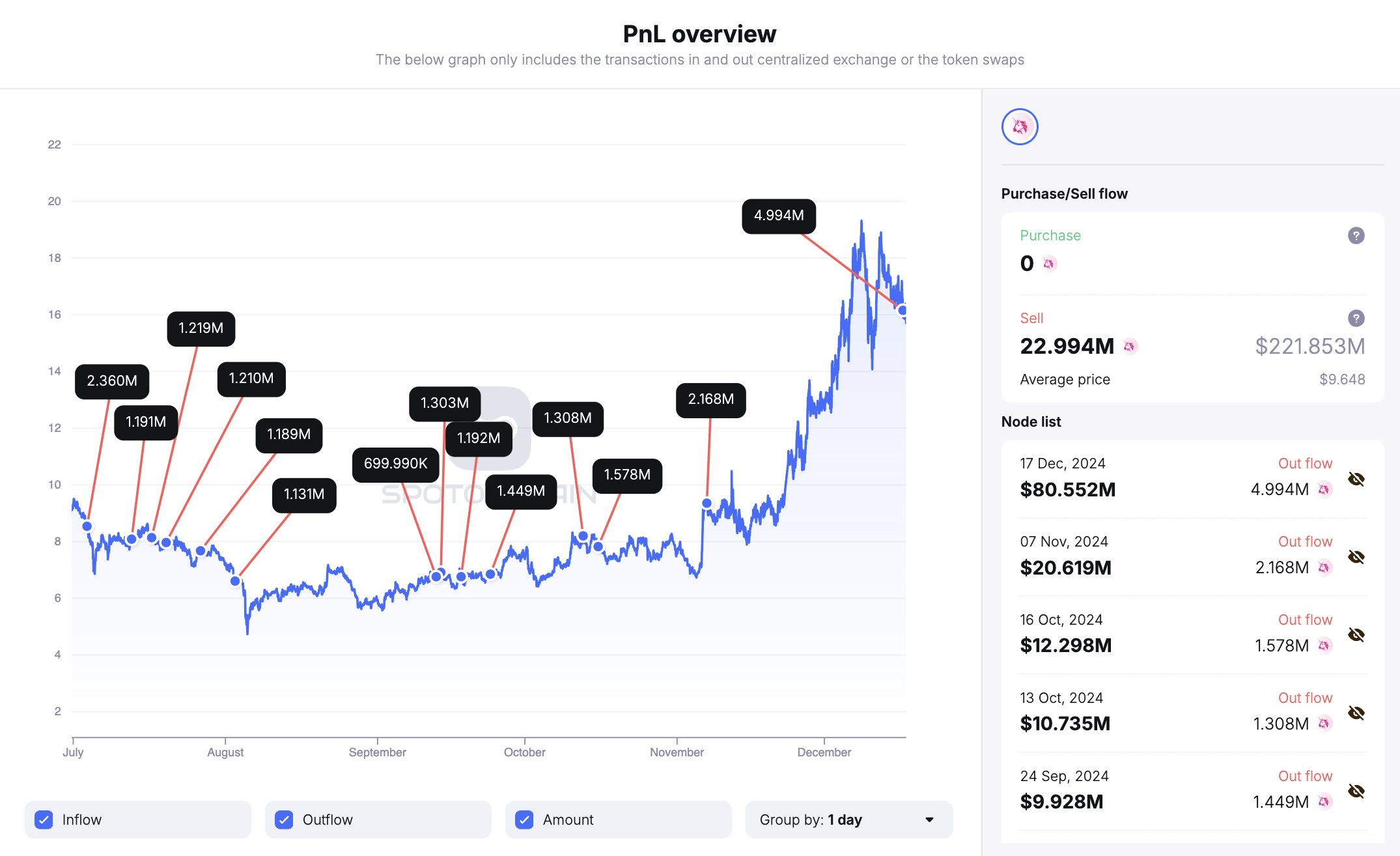

Furthermore, a wallet related to the Uniswap team, “0x837,” has sent nearly 5 million UNI tokens. The $80.97 million deposit over Coinbase Prime came after 4.25 years of dormancy. This move signifies strategic timing by the wallet owner amid volatile market conditions.

Further, after the deposit, the team wallet continues to hold $65.7 million worth of UNI tokens or 4.01 million UNI tokens. Such calculated offloading after prolonged dormancy emphasizes the potential for an intense market correction.

Since July 4, three dormant Uniswap team-related wallets have woken up, depositing 22.99 UNI tokens worth $221.85 million, with an average deposit price of $9.648.

Amid the offloading season, the Uniswap tokens sent over exchanges have reached the `800,000 mark in the past 24 hours, totaling over $13 million.

Uniswap Pictures Triangle Breakout to Cross $20

In the 4-hour chart, the Uniswap price action showcases the short-term correction testing a long-coming support trendline. This forms a symmetrical triangle pattern.

The Uniswap price is heading towards the bottleneck part of the triangle pattern. The Uniswap token trades at $16.32 with an intraday gain of 0.48%, highlighting its resilience despite the increasing supply pressure from whale deposits in a declining market.

As a market witness to the short-term correction, UNI price prepares for a breakout rally. The MACD indicator is ready for a positive crossover, increasing the chances of a breakout rally.

Based on the pivot point standard, the bullish breakout will likely challenge the $19.45 or the R1 resistance pivot level. In case of an extended rally, the uptrend could reach the $24.71 or the R3 level. On the flip side, the crucial support remains at $14.19. The ability to sustain this support will be critical for UNI to retain its upward momentum.

In conclusion, a breakout rally seems possible as Uniswap shows resilience under the broader market pressure.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vishal, a Bachelor of Science graduate, began his journey in the crypto space during the 2021 bull run and has since navigated the subsequent market winter. With a strong technical background, he is dedicated to delivering insightful articles rich in technical details, empowering readers to make well-informed decisions.