The 30-day MVRV ratio for AAVE was at -4%. Hence, it could be deemed relatively cheap and a great buy at current prices.

Key Notes

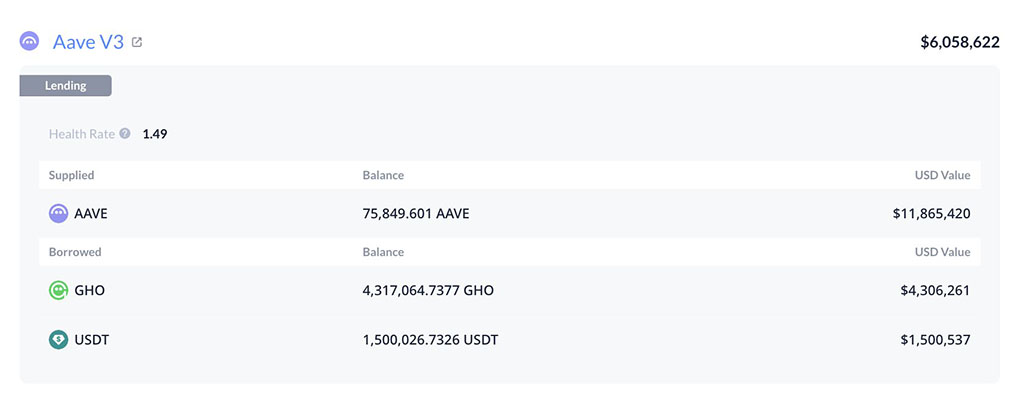

- A whale investor has added over 9K AAVE tokens to its massive long position.

- After the recent pullback from nearly $200 to $160, AAVE was relatively undervalued.

A whale investor has taken advantage of the mid-week pullback to build a massive long position on AAVE

AAVE

$160.6

24h volatility:

5.8%

Market cap:

$2.41 B

Vol. 24h:

$514.12 M

. According to blockchain analytics firm Lookonchain, the whale borrowed $1.5 million and bought over 9K AAVE. The latest scoop increased the investor’s portfolio, built since October, to a whopping 75.4K AAVE, worth $11.57 million.

Source: LookOnChain

Such massive whale bets are always seen as bullish convictions, signaling an imminent price rally. But what’s the potential RR (risk-to-reward) ratio, and does the current AAVE valuation offer a great market entry for bulls?

Is AAVE Cheap or Expensive?

At press time, AAVE was relatively undervalued according to the 30-day MVRV (Market Value to Realized Value) ratio. The MVRV ratio tracks the current price of an asset against the average cost of every token bought. A spike in the ratio indicates high unrealized profit and the potential to book profits and stall prices.

Source: Santiment

In short, a high MVRV suggests an asset is overvalued, while a lower or negative reading indicates a relatively undervalued token. At press time, the 30-day MVRV ratio for AAVE was at -4%; hence, it could be deemed relatively cheap and a great buy at current prices.

However, as of press time, large traders on the Binance exchange, especially on the perpetual markets, had not added massive long positions on AAVE.

Source: Hyblock

Like the rest of the market, whales added positions on US election day but trimmed exposure immediately after Trump’s victory. The Whale vs. Retail Delta indicator illustrated this.

That said, a strong AAVE price recovery could be feasible if more large players added positions at $160 or the Q4 support level of $120.

Source: AAVE/USDT, TradingView

On the price charts, the pullback offered a solid market entry opportunity for swing traders, especially if the market rebounds in the next few days. Notably, the price has dropped to a key confluence area ($160) of a moving average and breaker block (marked cyan).

Besides, the next support zone and bullish order block at $125-$135 (white zone) was another key level that could trigger a strong market rebound for AAVE. So, $160 and $125 could be key watchlists for market entry with immediate bullish targets at $180 and $200.

So, AAVE was relatively undervalued and a great buy at current prices. However, the bullish outlook could be invalidated if Bitcoin’s losses compound in the next few days or weeks.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Benjamin is a Telecommunication Engineering graduate who is passionate about crypto-markets and unraveling market trends. Armed with data, charts and patterns, he’s interested in making the intricate, complex landscape of digital assets easier for every user.